Marketing Technology: A Tale of Two Martech Stacks

Charles Dickens’ seminal novel A Tale of Two Cities, starts with the famous quote of “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

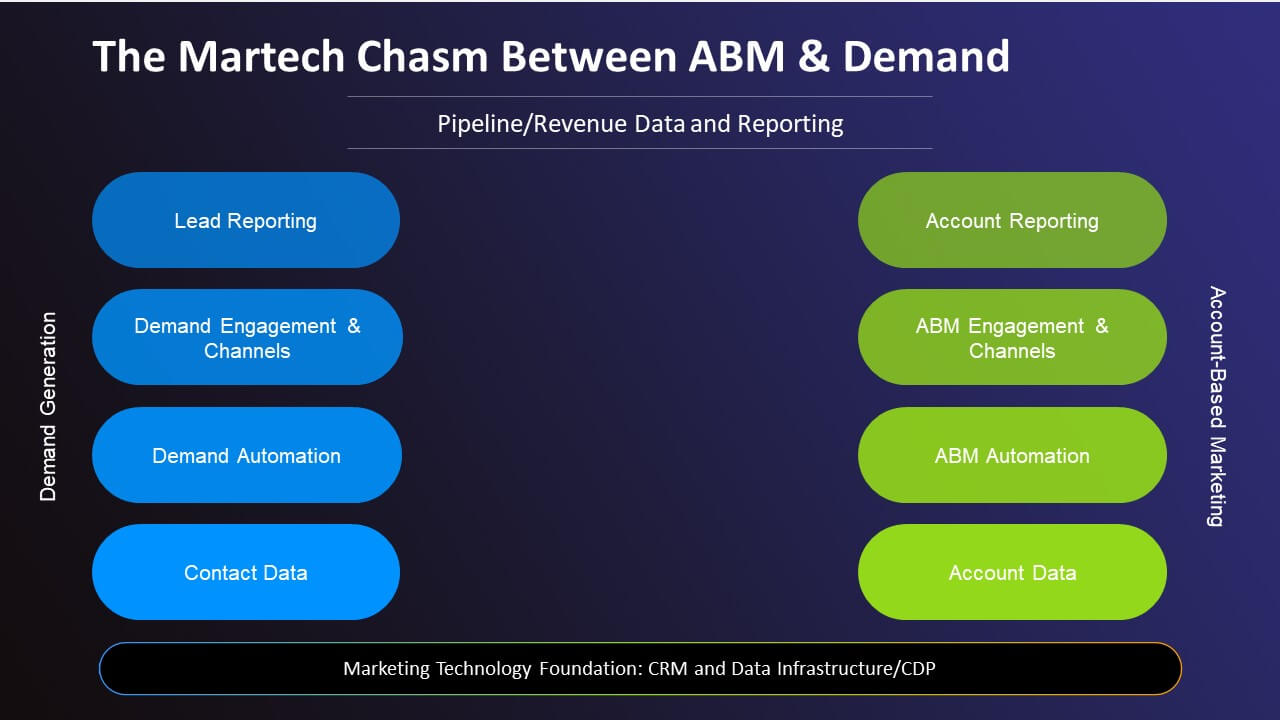

This sounds strikingly familiar to marketing operations professionals who have navigated marketing tech stacks the technology landscape for the past 15 years. There has been an explosion of new vendors and new offerings that promise to automate, simplify, and provide transparent reporting and clear ROI to the world of B2B marketing. There has been disillusionment as so many technologies fail to deliver on their promised benefits. There has been a flood of investment to build up the perfect martech stack. There is now pressure to optimize and consolidate existing technology to wring the maximum value from it. Worse, for many B2B marketing organizations, the past decade of technology investment has left them with two separate and distinct technology stacks—and no way to bridge the gap.

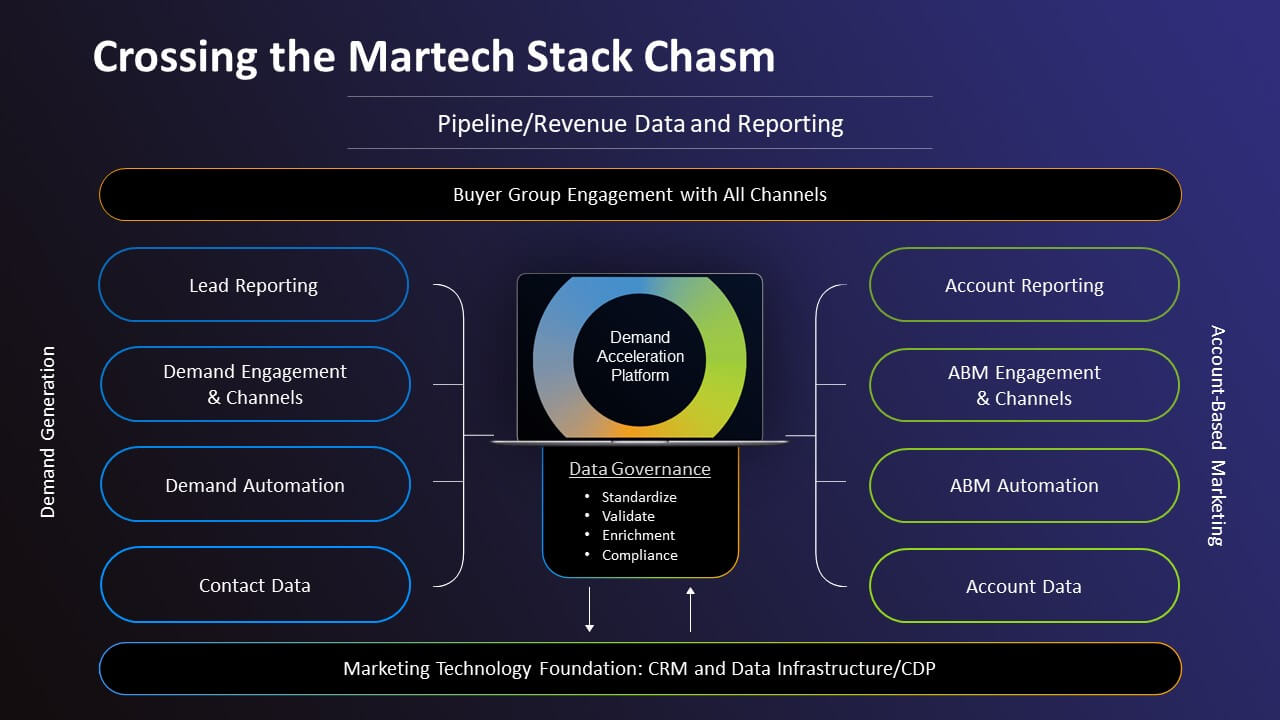

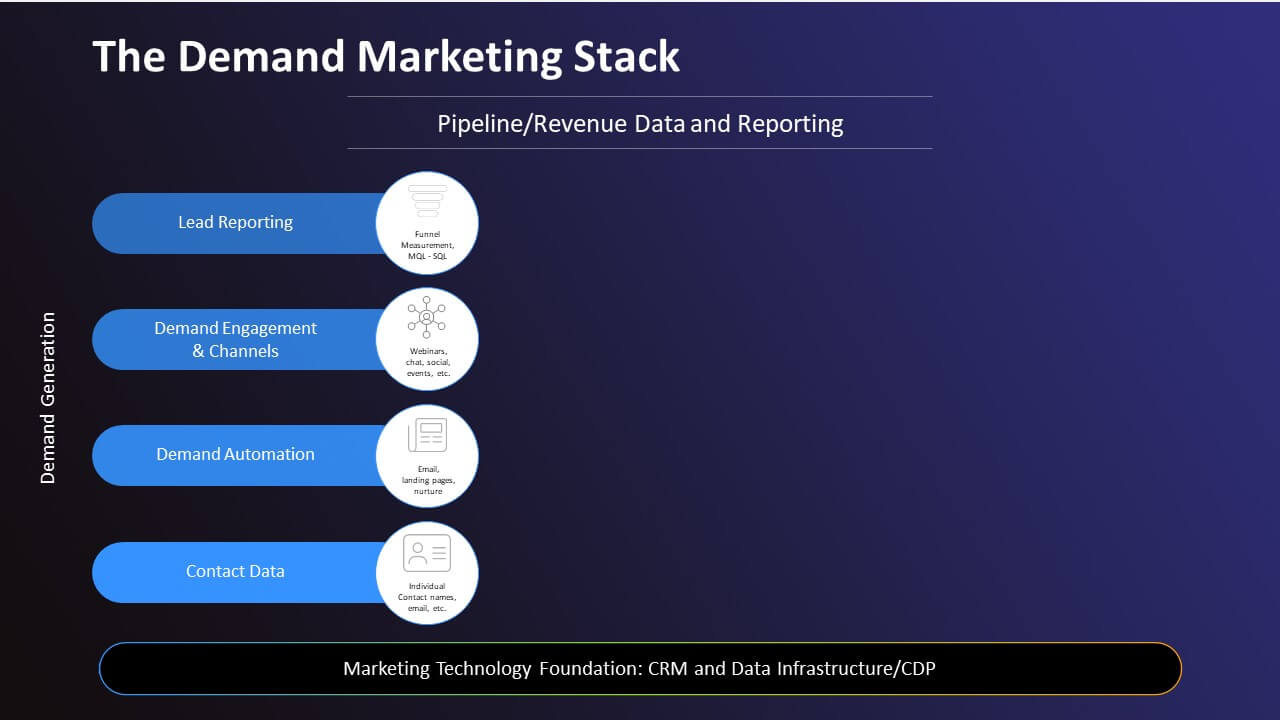

The Demand Marketing Tech Stack

Let’s start by examining a typical martech stack for classic B2B demand marketing. To start, there is a foundational layer that includes the customer relationship management (CRM) system and an underlying data structure (e.g., a data warehouse, data lake, and/or a customer data platform).

Then there are systems and tools in place to acquire and manage contact or lead data such as individual names, job titles, email addresses, etc. Tools in this category include list providers, data augmentation services, and data cleansing.

Next in the stack are the demand automation systems, typically a marketing automation platform (MAP) that automates the processes to develop, execute, and manage inbound and outbound marketing tactics as well as handle lead scoring and routing.

Connected to the MAP are all the systems for demand engagement and buyer interaction across multiple channels. Applications in this layer include web conferencing, chat bots, event management, social media platforms, etc.

At the top of the stack there is the reporting layer. This encompasses systems that track and report on the performance of demand marketing tactics and evaluate their outcomes on the marketing funnel. This includes the classic measures of lead volumes, velocity, and conversion by funnel stages (e.g., suspect, inquiry, MQL, SAL, SQL, opportunity, and closed/won.) These tools feed into the systems that the company uses to determine pipeline, booking, and revenue data and reporting.

What ties all the demand marketing tools together is a focus on leads—namely the contact information and digital activities of a potential individual buyer.

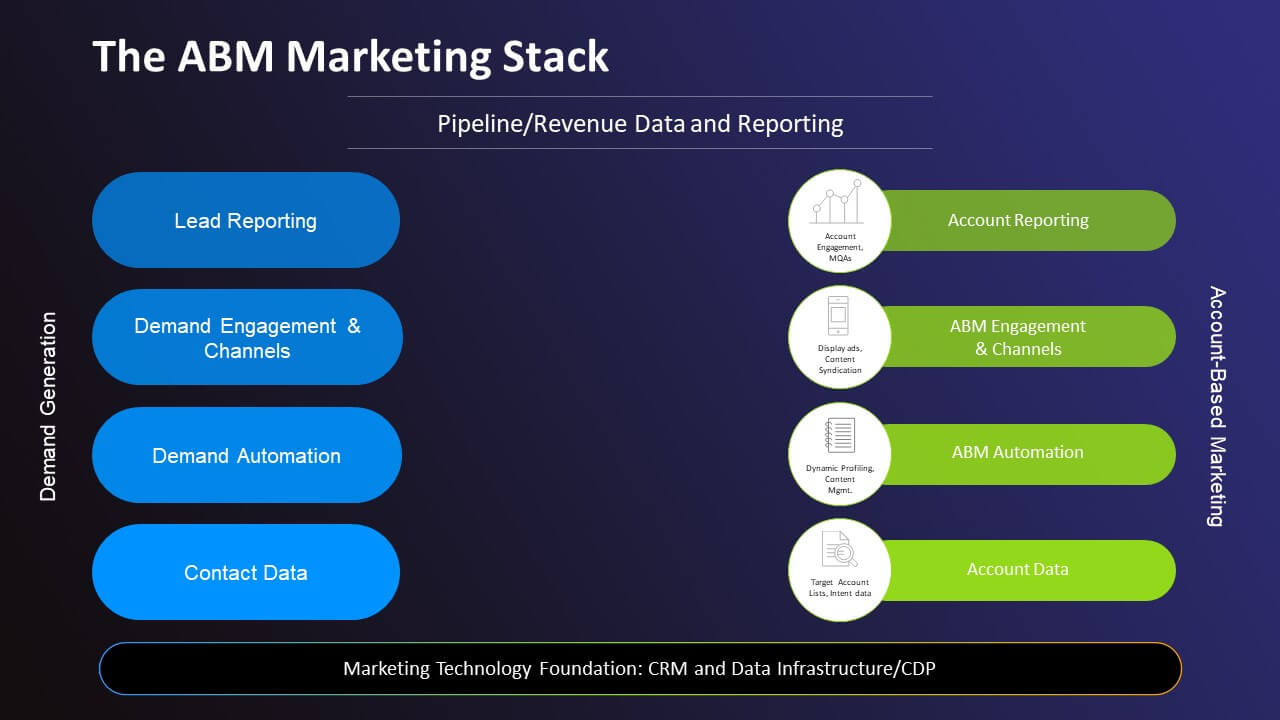

The ABM Marketing Technology Stack

The demand marketing stack grew to become the backbone of B2B marketing technology. That is, until account-based marketing (ABM) became the new, dominant marketing approach. Instead of a focus on the activity of individuals, ABM shifts the focus to target the key accounts that a company wished to start—or expand—doing business with. Nothing in the existing marketing tech stack would help to achieve this goal. So, a new, ABM-focused tech stack started to grow.

It was based on the same foundational layer of a CRM and a data infrastructure. But instead of a layer focused on contact data, marketing operations professionals began to invest in systems that would allow them to acquire, develop, and curate target account lists. Other vendors emerged that would allow the acquisition of intent data (e.g., the collection of behavioural signals that help interpret B2B purchase intent) for target accounts.

Next, ABM platforms (ABMPs) were added to the stack. Like MAPs, they were designed to automate the processes to deliver multichannel marketing orchestration against key accounts. Other functionality included the identification of anonymous digital activity based on company domains, dynamic profiling, and content management capabilities.

Then, there were systems to connect to the ABMPs for account engagement across different channels. This layer includes vendors offering display advertising to target accounts, content syndication, and social media, among other channels.

And then there is a reporting layer. The systems here measure the performance of ABM tactics against target accounts and track KPIs such as account engagement, marketing engaged accounts (MQAs), and influence of account opportunities and pipeline.

What ties the ABM technology together is a focus on account—namely the aggregate information and intent signals of a potential business entity that a B2B organizations wishes to have a contractual relationship with.

The Great Martech Gap

So now B2B marketers have a robust martech stack. In fact, they have two of them—but with a significant gap in the middle that needs to be addressed, as it makes little sense to operate separate lead- and account-centric technology solutions.

This is especially true since B2B buying behavior has dramatically changed since the Covid pandemic of 2020. Accounts don’t buy; people buy. And for B2B purchasing, individuals don’t buy; buying groups do. In fact, the average size of a typical buying group is now 12—18 people. To complete a successful buying cycle, data from Forrester’s 2021 B2B Buying Survey shows that approximately 27 connected and personal touches are required for each member of the buying group. None of the technology in the current martech stack provides data, automation, engagement, or insights into the composition, activities, or interactions of a B2B buying group.

This is a huge miss for B2B marketing and sales. With current marketing tech tools, marketing can’t build out the members of a buying group within target accounts. They can’t alert sales to an uptick in account-specific buying group activity. They can’t view account engagement across all marketing channels and programs.

Or can they?

The Marketing Technology Bridge: Integrate Demand Acceleration Platform

To gain visibility to buying groups, marketing operations professionals can build a third martech stack (that is, once vendors have begun to introduce technology to address buying group requirements)—or they can simply add the Integrate Demand Acceleration Platform (DAP) into the existing gap in their tech stacks.

Integrate DAP is a SaaS tool that centralizes and connects the multichannel B2B buying experience and augments existing demand and ABM technologies. DAP has a data governance engine to collect, standardize, validate, and enrich data from all marketing delivery channels, as well as ensure compliance with global privacy regulations. This provides the insights necessary to build effective, personalized buying group experiences. DAP connects channels, processes, and tools across both the demand and ABM tech stacks to create an efficient demand engine. DAP delivers insights such as identification of the campaigns, channels, and content that deliver the best results for key accounts—and allows B2B marketers a holistic view of buying group engagement within accounts across all channels and programs.

For smart marketing operations professionals who want to quickly pivot to support buying groups and leverage their significant marketing technology investments, it’s an easy decision. To quote Charles Dickens again, “It is a far, far better thing that I do, than I have ever done; it is a far, far better rest that I go to than I have ever known.”